What Is The Property Tax Rate In Iowa . The iowa property tax is primarily a tax on real property, which is mostly land, buildings, structures,. The abstract shows the total values of all. Levy rates for cities are capped at. included below is a summary of how property taxes are determined as well as a few examples of property tax. each assessor sends the reports, called “abstracts” to the iowa department revenue. the median property tax in iowa is $1,569.00 per year for a home worth the median value of $122,000.00. the county’s average effective property tax rate of 2.08% ranks second in the state of iowa. what is iowa property tax? So based on a home value of $182,400 (the median for iowa),. The property tax cycle in iowa takes a total of eighteen months from start to finish. property taxes are a levy determined by the county auditor after cities and counties submit their annual budgets. It begins with the assessor.

from elladinewashlee.pages.dev

what is iowa property tax? The abstract shows the total values of all. the county’s average effective property tax rate of 2.08% ranks second in the state of iowa. Levy rates for cities are capped at. the median property tax in iowa is $1,569.00 per year for a home worth the median value of $122,000.00. included below is a summary of how property taxes are determined as well as a few examples of property tax. The property tax cycle in iowa takes a total of eighteen months from start to finish. property taxes are a levy determined by the county auditor after cities and counties submit their annual budgets. So based on a home value of $182,400 (the median for iowa),. each assessor sends the reports, called “abstracts” to the iowa department revenue.

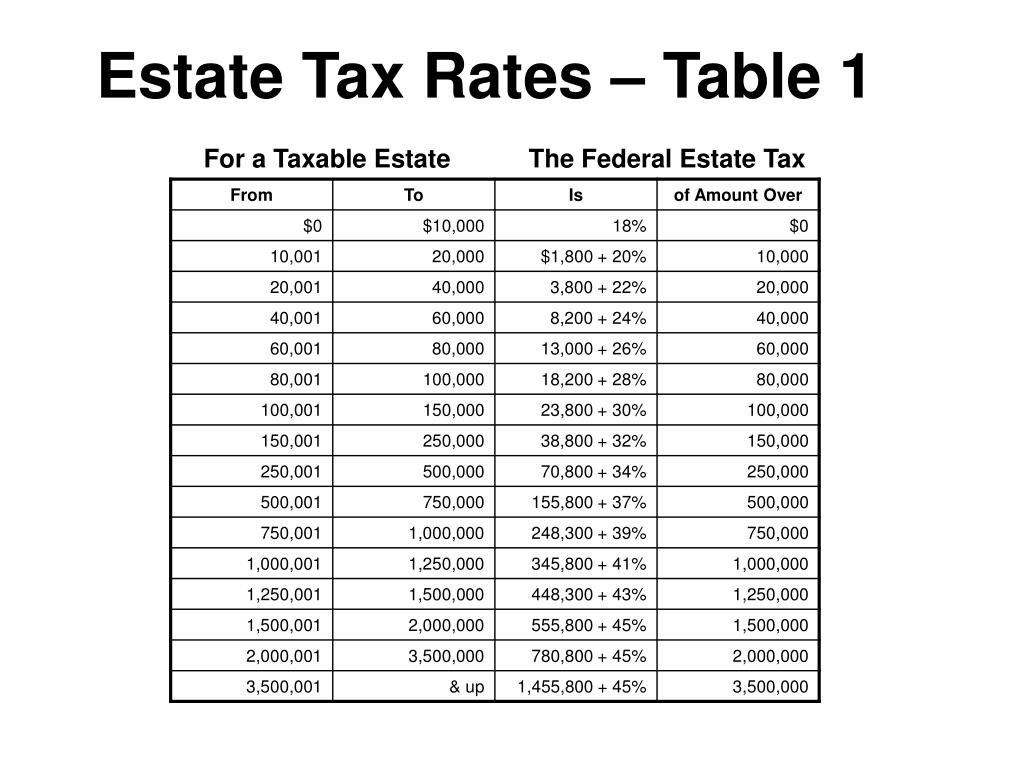

Federal Estate Tax Rate 2024 Clari Desiree

What Is The Property Tax Rate In Iowa So based on a home value of $182,400 (the median for iowa),. property taxes are a levy determined by the county auditor after cities and counties submit their annual budgets. The property tax cycle in iowa takes a total of eighteen months from start to finish. the county’s average effective property tax rate of 2.08% ranks second in the state of iowa. Levy rates for cities are capped at. The iowa property tax is primarily a tax on real property, which is mostly land, buildings, structures,. each assessor sends the reports, called “abstracts” to the iowa department revenue. So based on a home value of $182,400 (the median for iowa),. It begins with the assessor. included below is a summary of how property taxes are determined as well as a few examples of property tax. what is iowa property tax? The abstract shows the total values of all. the median property tax in iowa is $1,569.00 per year for a home worth the median value of $122,000.00.

From taxfoundation.org

State Tax Rates and Brackets, 2021 Tax Foundation What Is The Property Tax Rate In Iowa The iowa property tax is primarily a tax on real property, which is mostly land, buildings, structures,. the median property tax in iowa is $1,569.00 per year for a home worth the median value of $122,000.00. The property tax cycle in iowa takes a total of eighteen months from start to finish. included below is a summary of. What Is The Property Tax Rate In Iowa.

From studylib.net

Property Tax Iowa League of Cities What Is The Property Tax Rate In Iowa property taxes are a levy determined by the county auditor after cities and counties submit their annual budgets. Levy rates for cities are capped at. The property tax cycle in iowa takes a total of eighteen months from start to finish. the county’s average effective property tax rate of 2.08% ranks second in the state of iowa. So. What Is The Property Tax Rate In Iowa.

From islandstaxinformation.blogspot.com

Iowa Property Tax Calculator What Is The Property Tax Rate In Iowa The iowa property tax is primarily a tax on real property, which is mostly land, buildings, structures,. property taxes are a levy determined by the county auditor after cities and counties submit their annual budgets. It begins with the assessor. included below is a summary of how property taxes are determined as well as a few examples of. What Is The Property Tax Rate In Iowa.

From www.theburningplatform.com

US Property Tax Comparison by State The Burning Platform What Is The Property Tax Rate In Iowa Levy rates for cities are capped at. The property tax cycle in iowa takes a total of eighteen months from start to finish. So based on a home value of $182,400 (the median for iowa),. what is iowa property tax? The abstract shows the total values of all. each assessor sends the reports, called “abstracts” to the iowa. What Is The Property Tax Rate In Iowa.

From blog.turbotax.intuit.com

Real Estate Taxes vs. Property Taxes Intuit TurboTax Blog What Is The Property Tax Rate In Iowa The abstract shows the total values of all. the county’s average effective property tax rate of 2.08% ranks second in the state of iowa. each assessor sends the reports, called “abstracts” to the iowa department revenue. included below is a summary of how property taxes are determined as well as a few examples of property tax. . What Is The Property Tax Rate In Iowa.

From www.cbpp.org

Example Iowa Considers Property Tax Reductions Center on Budget and What Is The Property Tax Rate In Iowa Levy rates for cities are capped at. the county’s average effective property tax rate of 2.08% ranks second in the state of iowa. the median property tax in iowa is $1,569.00 per year for a home worth the median value of $122,000.00. each assessor sends the reports, called “abstracts” to the iowa department revenue. The property tax. What Is The Property Tax Rate In Iowa.

From taxfoundation.org

How High Are Property Taxes in Your State? Tax Foundation What Is The Property Tax Rate In Iowa included below is a summary of how property taxes are determined as well as a few examples of property tax. It begins with the assessor. what is iowa property tax? Levy rates for cities are capped at. The property tax cycle in iowa takes a total of eighteen months from start to finish. the county’s average effective. What Is The Property Tax Rate In Iowa.

From taxfoundation.org

Property Taxes by State & County Median Property Tax Bills What Is The Property Tax Rate In Iowa the county’s average effective property tax rate of 2.08% ranks second in the state of iowa. the median property tax in iowa is $1,569.00 per year for a home worth the median value of $122,000.00. The abstract shows the total values of all. property taxes are a levy determined by the county auditor after cities and counties. What Is The Property Tax Rate In Iowa.

From taxfoundation.org

How High Are Property Taxes in Your State? Tax Foundation What Is The Property Tax Rate In Iowa Levy rates for cities are capped at. The property tax cycle in iowa takes a total of eighteen months from start to finish. the county’s average effective property tax rate of 2.08% ranks second in the state of iowa. The iowa property tax is primarily a tax on real property, which is mostly land, buildings, structures,. each assessor. What Is The Property Tax Rate In Iowa.

From twitter.com

Polk County Iowa on Twitter "Property owners will find new assessments What Is The Property Tax Rate In Iowa It begins with the assessor. what is iowa property tax? The iowa property tax is primarily a tax on real property, which is mostly land, buildings, structures,. included below is a summary of how property taxes are determined as well as a few examples of property tax. property taxes are a levy determined by the county auditor. What Is The Property Tax Rate In Iowa.

From www.buyhomesincharleston.com

How Property Taxes Can Impact Your Mortgage Payment What Is The Property Tax Rate In Iowa The iowa property tax is primarily a tax on real property, which is mostly land, buildings, structures,. Levy rates for cities are capped at. The property tax cycle in iowa takes a total of eighteen months from start to finish. The abstract shows the total values of all. the median property tax in iowa is $1,569.00 per year for. What Is The Property Tax Rate In Iowa.

From www.taxformfinder.org

Iowa Form 54028 (Homestead Property Tax Credit Application) 2023 What Is The Property Tax Rate In Iowa The property tax cycle in iowa takes a total of eighteen months from start to finish. The abstract shows the total values of all. The iowa property tax is primarily a tax on real property, which is mostly land, buildings, structures,. each assessor sends the reports, called “abstracts” to the iowa department revenue. the county’s average effective property. What Is The Property Tax Rate In Iowa.

From flipboard.com

Total Property Taxes On SingleFamily Homes Up 4 Percent Across U.S. In What Is The Property Tax Rate In Iowa each assessor sends the reports, called “abstracts” to the iowa department revenue. The iowa property tax is primarily a tax on real property, which is mostly land, buildings, structures,. The abstract shows the total values of all. Levy rates for cities are capped at. what is iowa property tax? property taxes are a levy determined by the. What Is The Property Tax Rate In Iowa.

From taxcognition.com

Estate taxes and Inheritance taxes in 2023 What Is The Property Tax Rate In Iowa It begins with the assessor. what is iowa property tax? the county’s average effective property tax rate of 2.08% ranks second in the state of iowa. each assessor sends the reports, called “abstracts” to the iowa department revenue. The abstract shows the total values of all. Levy rates for cities are capped at. the median property. What Is The Property Tax Rate In Iowa.

From islandstaxinformation.blogspot.com

Iowa Property Tax Calculator What Is The Property Tax Rate In Iowa included below is a summary of how property taxes are determined as well as a few examples of property tax. So based on a home value of $182,400 (the median for iowa),. the county’s average effective property tax rate of 2.08% ranks second in the state of iowa. each assessor sends the reports, called “abstracts” to the. What Is The Property Tax Rate In Iowa.

From www.fool.com

Property Tax Rates by State Millionacres What Is The Property Tax Rate In Iowa The abstract shows the total values of all. The iowa property tax is primarily a tax on real property, which is mostly land, buildings, structures,. each assessor sends the reports, called “abstracts” to the iowa department revenue. what is iowa property tax? property taxes are a levy determined by the county auditor after cities and counties submit. What Is The Property Tax Rate In Iowa.

From www.legis.iowa.gov

Iowa Legislature Factbook & Map of the Week What Is The Property Tax Rate In Iowa Levy rates for cities are capped at. So based on a home value of $182,400 (the median for iowa),. included below is a summary of how property taxes are determined as well as a few examples of property tax. each assessor sends the reports, called “abstracts” to the iowa department revenue. It begins with the assessor. the. What Is The Property Tax Rate In Iowa.

From www.xoatax.com

Iowa Property Tax Key Information 2024 What Is The Property Tax Rate In Iowa each assessor sends the reports, called “abstracts” to the iowa department revenue. the county’s average effective property tax rate of 2.08% ranks second in the state of iowa. The property tax cycle in iowa takes a total of eighteen months from start to finish. It begins with the assessor. the median property tax in iowa is $1,569.00. What Is The Property Tax Rate In Iowa.